Dating apps like Tinder fix the problem of finding someone to go on a date with. But the knock-on effect of that is needing to invest time making small talk on dating apps in order to acquire a date.

U.K. startup rendeevoo, which makes an iOS dating app, aims to ‘fix’ both of these issues in one cocktail-fueled swoop — provided you aren’t someone who relies on that real-time chatting component of dating apps to, y’know, assess whether you actually want to spend any time in the same room as this other person or not.

If you screen dates at the spelling and grammar stage, rendeevoo is not for you. But if you couldn’t care less about how many lols, !!!!s and emojis infest a prospective date’s IMspeak — or indeed what they talk about — instead choosing to select a date based purely on their photos, age and profile, then read on…

Billing itself as an ‘Uber for real life dates’, rendeevoo cuts to the chase by cutting out the chat element. “We want to allow people enjoy their real life instead of wasting time in front of their screens chatting with others asynchronously,” says co-founder George Christoforakis, who came up with the idea for the app back in 2011, pre-Tinder, after signing up for a dating site for the first time.

“I quickly realised that asynchronous communications is an obstacle to the ones who prefer to know someone in person rather than through their screen. I also faced the usual threats that exist in such environments, like fake profiles and spammers/scammers, and started questioning the ethics of these big dating providers whose business models highlight a paradox: they promise to match me with the person of my dreams, but they earn money if I don’t.”

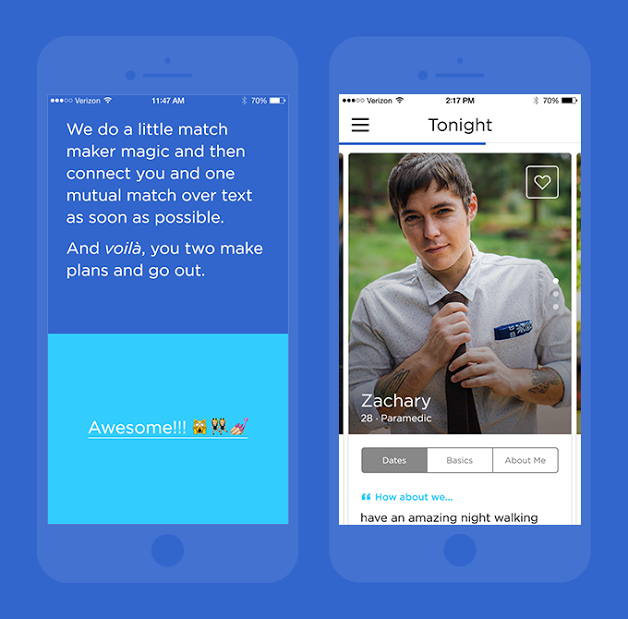

Users of rendeevoo browse profiles and when they like the look and description of a prospective date they can place ‘an order’, just like they would check-out any other e-commerce item, by selecting when and where they want the date to take place, and then paying for it. Specifically they are paying for one cocktail at one of the handful of East London bars that rendeevoo has partnered with thus far.

Once — or, let’s be honest, if — the prospective date also pays for their own drink the date is confirmed. Both parties have to confirm before the transactions are processed. And it is still possible to cancel a date up to 30 minutes before without being penalized, so this app isn’t a perfect fix for being stood up at the last minute.

Users are authenticated via their Facebook profile, and also need to provide card details to pay for drinks (with payments processed via Stripe), so Christoforakis claims there’s “no risk of being catfished or spammed” — something he reckons is “common” on existing dating platforms.

The app soft launched in April 2014, but officially launched in beta last month and is now stepping up marketing activity in its East London target area.

We came across rendeevoo pitching at our Barcelona mini meet-up, back in February. The London-based startup has raised just under $150,000 over the past 10 months, with around $50,000 pulled in from crowdfunding (via Seedrs), and the rest from two angel investors (Georgios Markakis and Cedric van der Haert).

Usage thus far is small, as you’d expect, with less than 1,200 active users at this point, and only five Shoreditch bars to choose from — although the startup says it should have doubled that by the end of the month.

How many rendeevoo dates have people actually gone on thus far? A mere 13, says Christoforakis. The current usage also skews 1:3 in favor of male users. And therein, perhaps, lies the rub.

Rendeevoo — yet another dating app designed by men — appears to be fixated on fixing more of a male problem (quick date acquisition), and it’s tackling that by removing the screening element which — I’d wager — pretty much any female (or indeed any discerning person) would tell you is an integral part of deciding whether to bother wasting time going on a date in the first place.

Sure in-app IMing may be time-consuming, but what’s far more tedious is being stuck in a bar with a moron.

Still, the app isn’t only targeting straight dating. And given its current gender skew it may well be proving more of a hit with men seeking likeminded men — although Christoforakis says it has no strong bias in any direction at this nascent stage.

“Our main user is not particularly male or female, straight or not. Of course the value proposition addresses more male users’ needs, but there is an increasing number of female users who find our product as a great solution to their socialising needs,” he says, when I ask who the app is for.

“A busy young professional, irrespectively of their sex or sexuality, will find rendeevoo as a great choice for a cheeky drink with someone new. We enforce that perception by not promising a great ‘match’. We limit our expertise to the overall experience that is a convenient way to meet someone at a great place today. Even if there’s little chemistry between two users, they still had a great time at our partnering bars enjoying a tasty cocktail,” he adds.

If rendeevoo can locate enough trendy East London quick-after-work-drink seekers to drive significant traction it’s aiming to monetize the app via commissions charged to partnering bars for each booking. After that Christoforakis says it would look to add complementary services (such as taxi rides) to expand its revenue generating potential, as well as seeking commercial sponsorships with drinks brands.

View the original article here